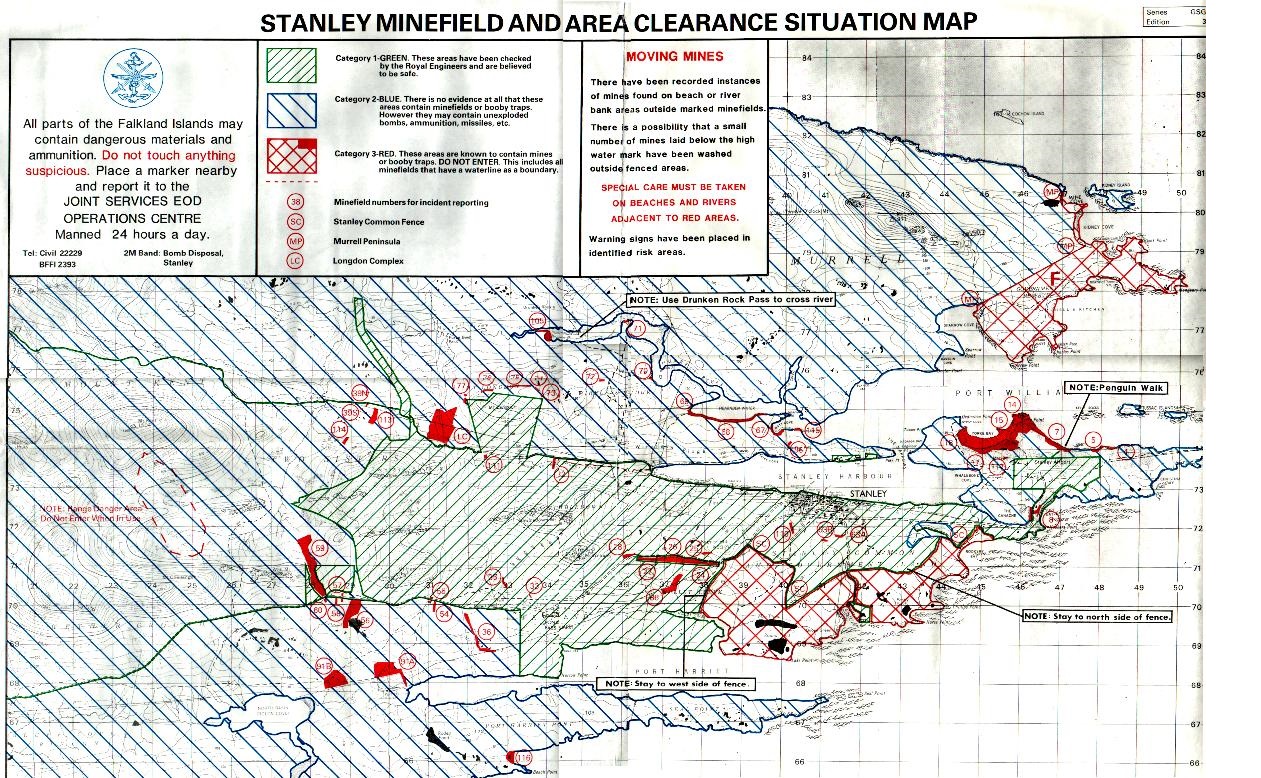

We see life as something of a ‘minefield’.

…

We carry a picture in our minds that is like a map. Ideas that are safe to hold [green], ideas that are a bit controversial [blue] and some definite no-go areas [red].…

But what if we did not have any preconceived ideas? We would be more like the sheep that can’t read the ‘Danger Mines’ signs. They are oblivious and happy.

Are we better or worse off than the sheep?

…

Neither option feels right.

…

If there really ARE mines in there, then we really don’t want to go there. But what about the places where we are not sure? Are we just frightened because we don’t know?

…

Or are we wary because someone else is frightened?

…

In business, I would say that is more often than not this last. We don’t take risks because we are making our bosses frightened. Of being seen as irresponsible, overseeing mistakes being made and ultimately losing their jobs.

…

How do we get past this? How do you test an area to see if it is safe? What is the equivalent of ‘sending the sheep in first’?

…

Our answer is to build models.

…

Models can be exploration devices. A way of going somewhere in your mind before you set foot there. It’s completely safe. It’s all about ‘What If?’ We have called our book ‘Bridge of Faith’ for Operations, because you can simulate crossing a chasm without actually stepping into the void. Visions are what makes leaders stand out. Some follow naturally, most need to be coaxed. A model is a coax…and a coach. It teaches while it explores.